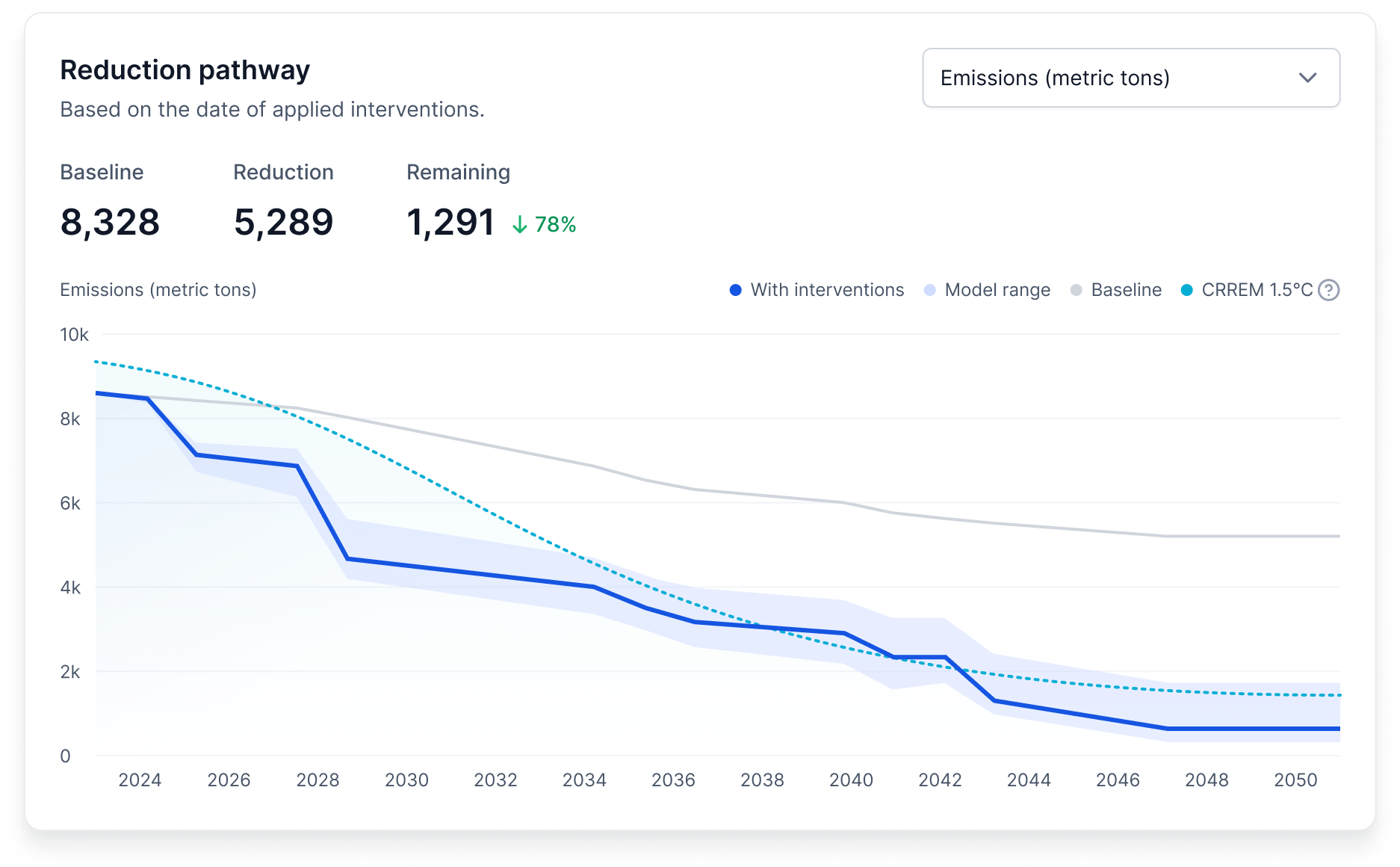

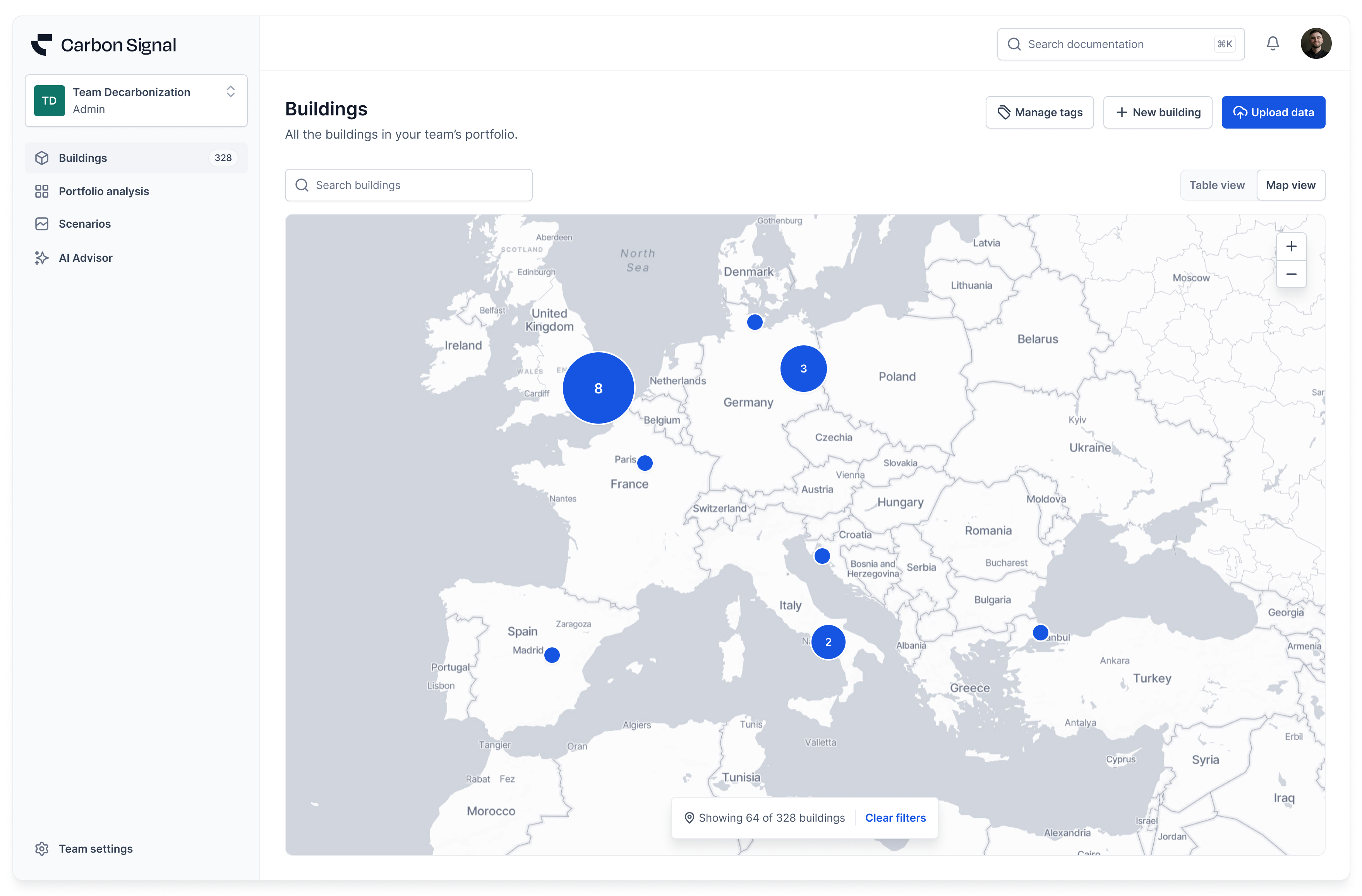

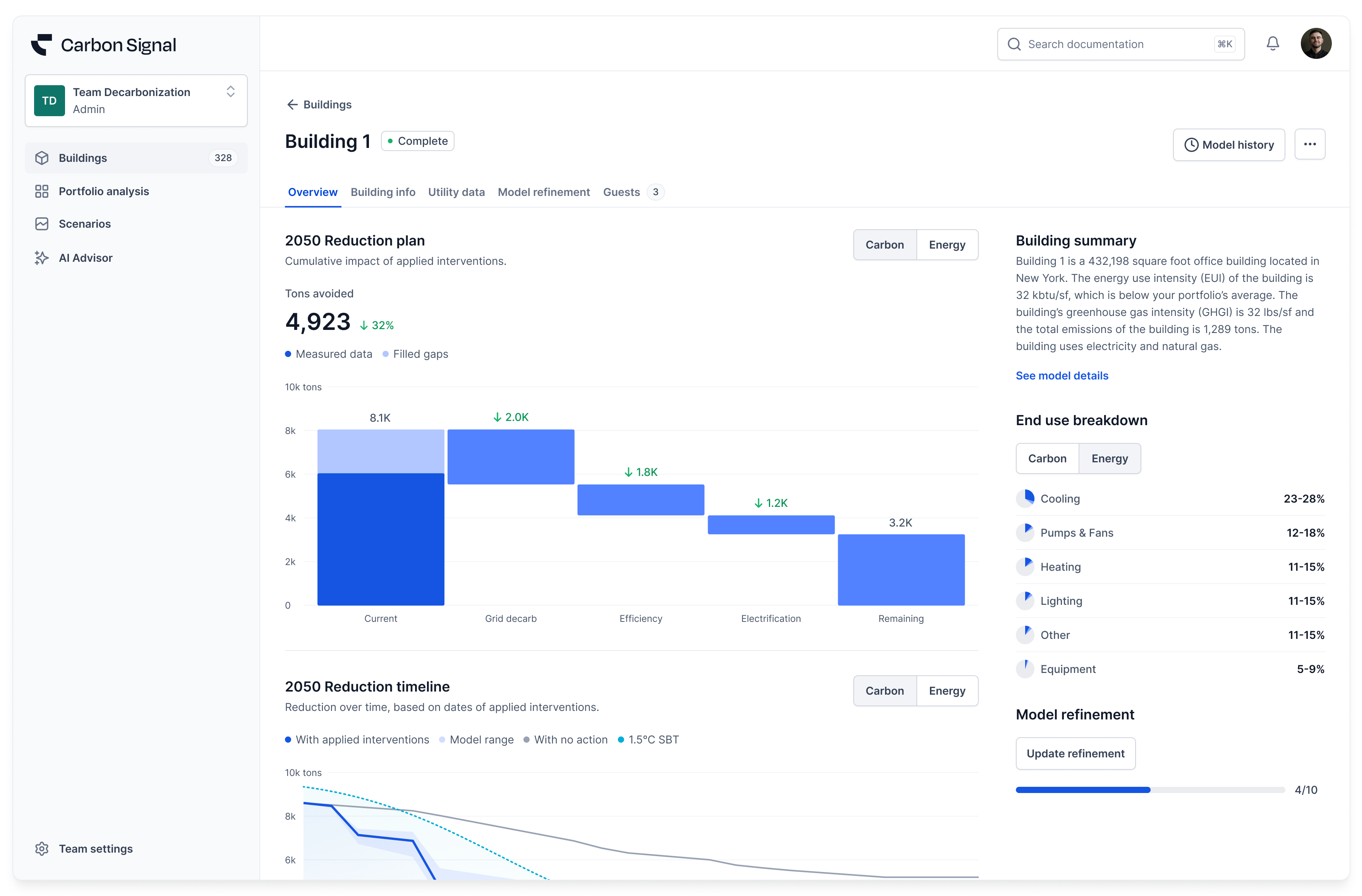

This release strengthens Carbon Signal’s ability to support scalable decarbonization analysis by improving how buildings are created and how interventions are evaluated. With a guided building setup workflow and enhanced portfolio analysis tools, it is now easier to input data, refine assumptions, and compare outcomes across buildings with greater clarity and flexibility.

Multiple Data Input Methods

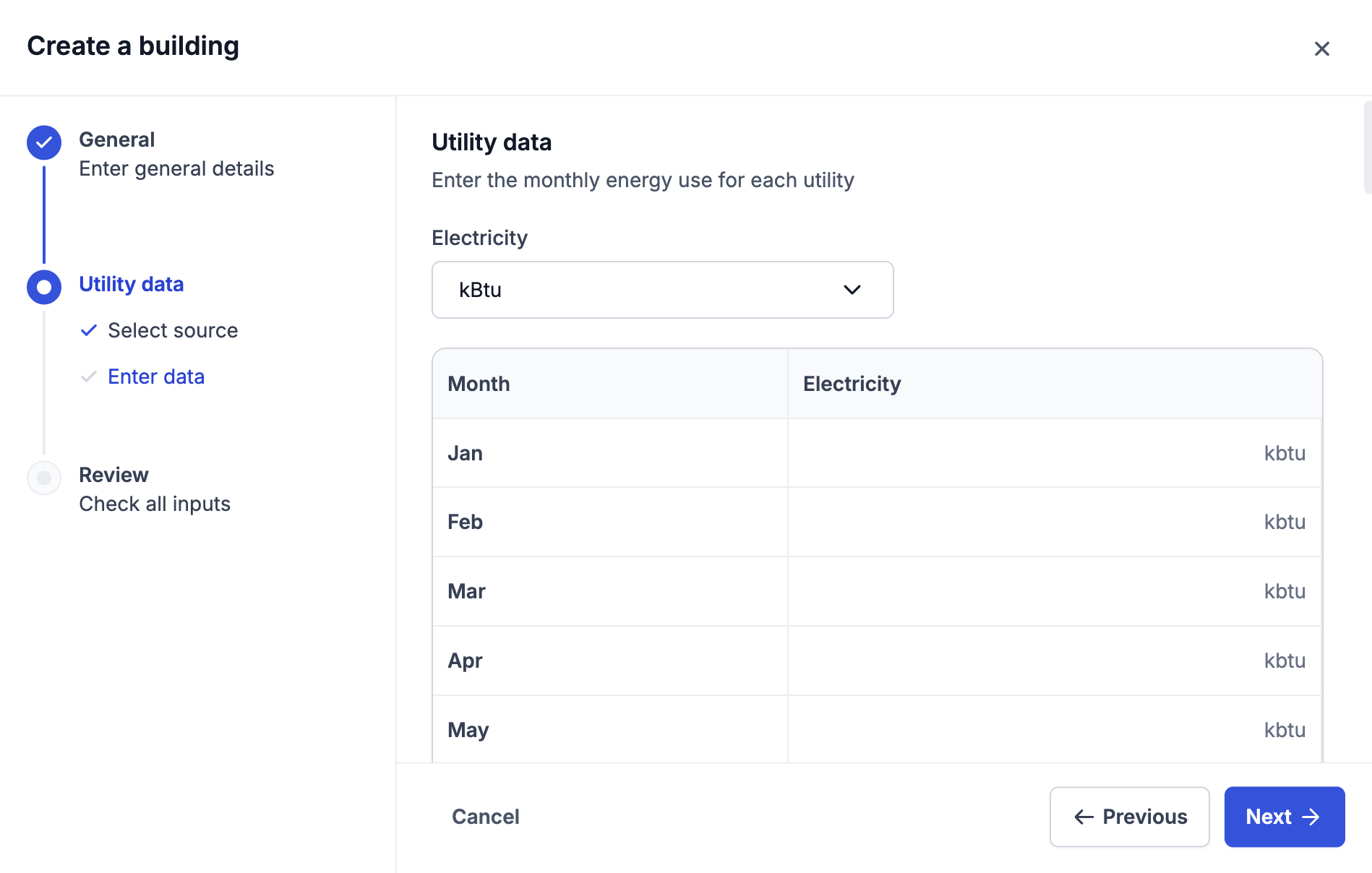

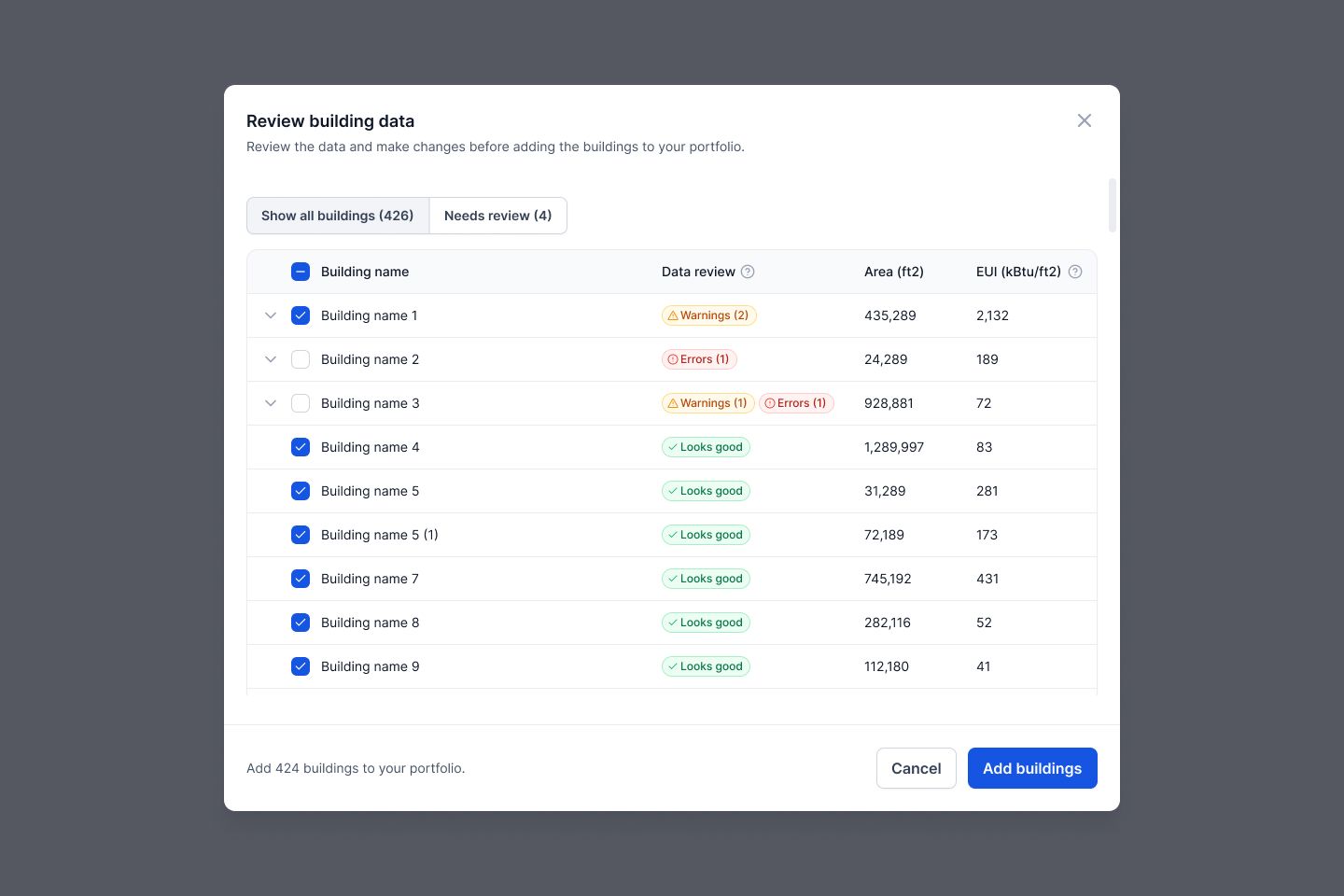

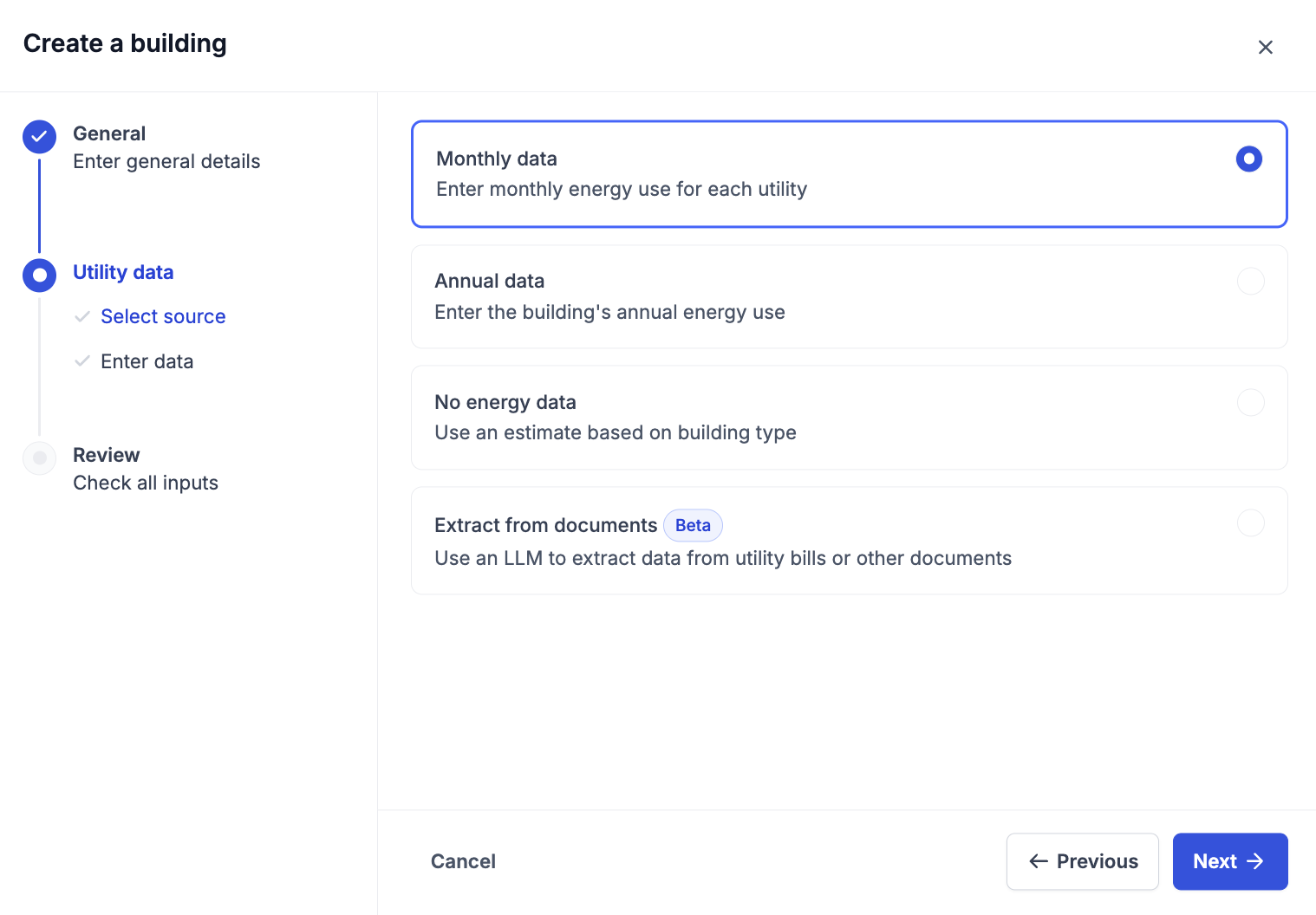

Carbon Signal now includes a step-by-step wizard for creating individual buildings. The workflow guides users through entering building details, selecting a data source, and reviewing inputs before finalizing the building.

This structured approach helps ensure required information is captured consistently, making it easier to create begin analysis quickly.

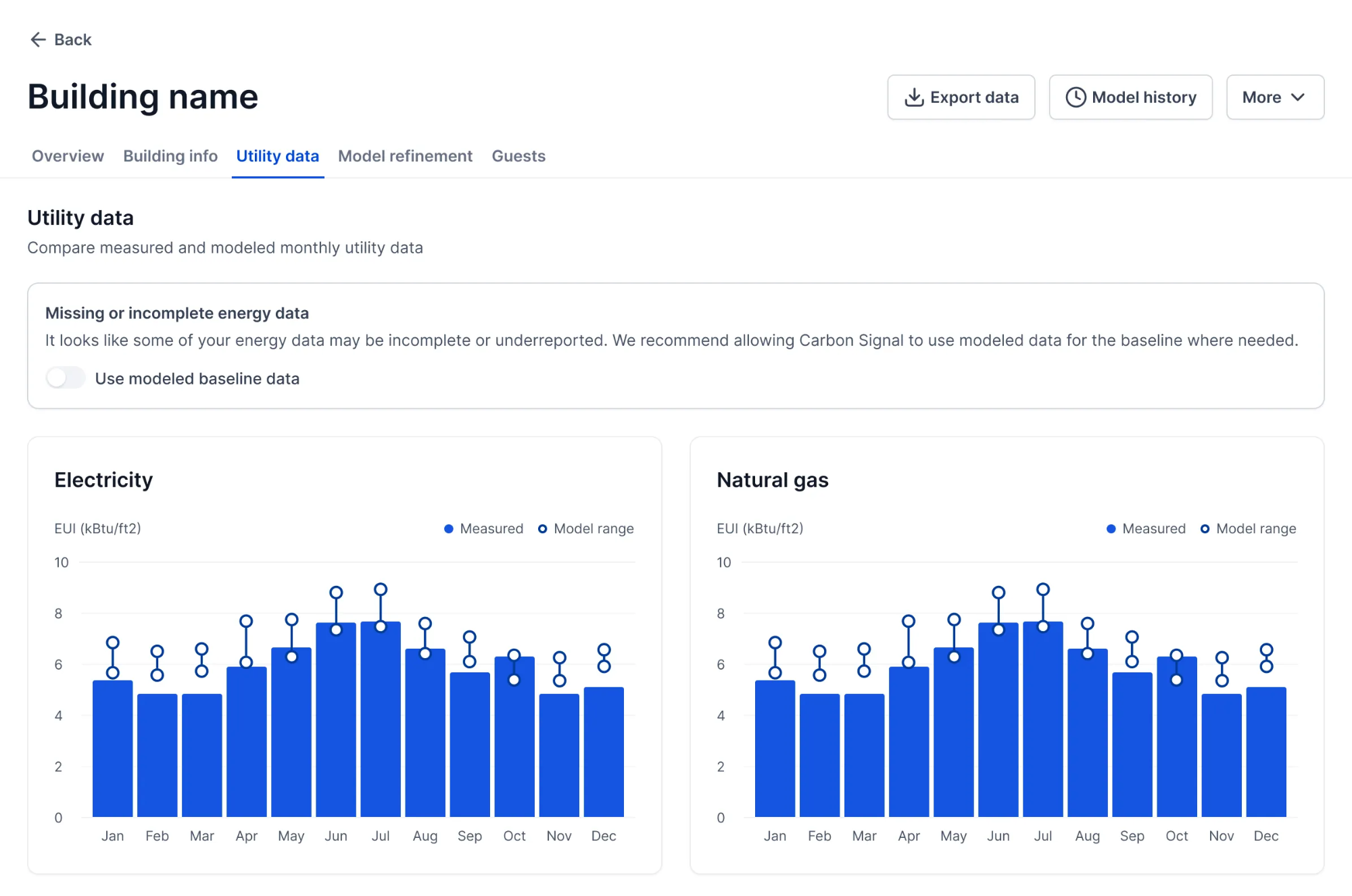

Users can now choose from several methods to provide building energy data, depending on availability:

- Monthly data – Enter detailed monthly energy consumption for each utility

- Annual data – Provide a single annual energy intensity value

- No energy data – Generate an estimated model based on building type

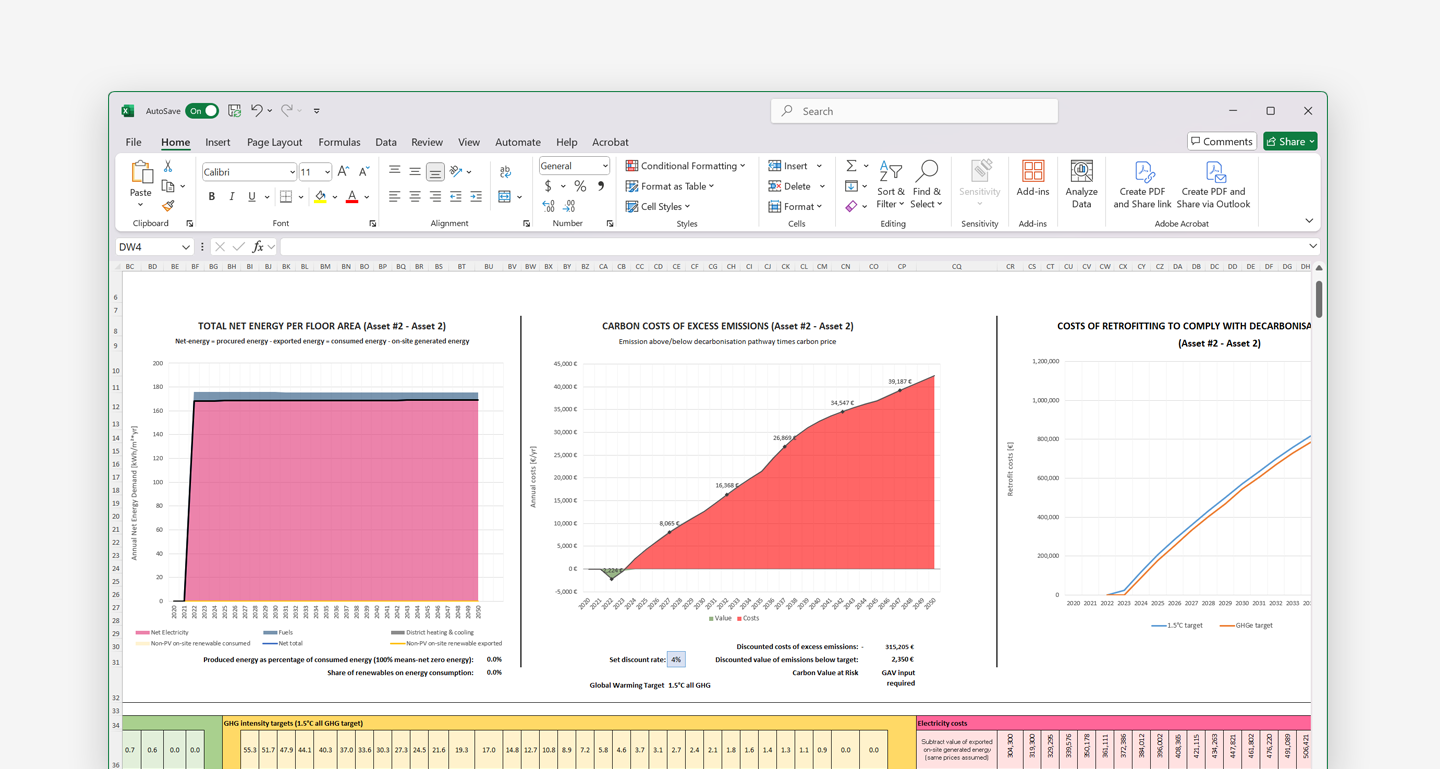

- Extract from documents (Beta) – Carbon Signal now supports extracting utility data directly from documents using a language model. Users can upload files such as utility bills, energy audit reports, or spreadsheets, and the platform will automatically identify and extract relevant energy data.

With the AI-powered data extraction from documents, Carbon Signal reduces the need for manual data entry and makes it easier to ingest historical utility data that is often stored in unstructured formats. By converting documents into structured inputs, users can quickly incorporate existing reports into their analysis workflows.

The ability to create buildings with limited or no data enables faster analysis in real-world scenarios, such as:

- Acquisition due diligence where utility data is unavailable

- Portfolio-wide analysis with incomplete datasets

This makes it easier to include every building in decarbonization planning, even when data is incomplete.

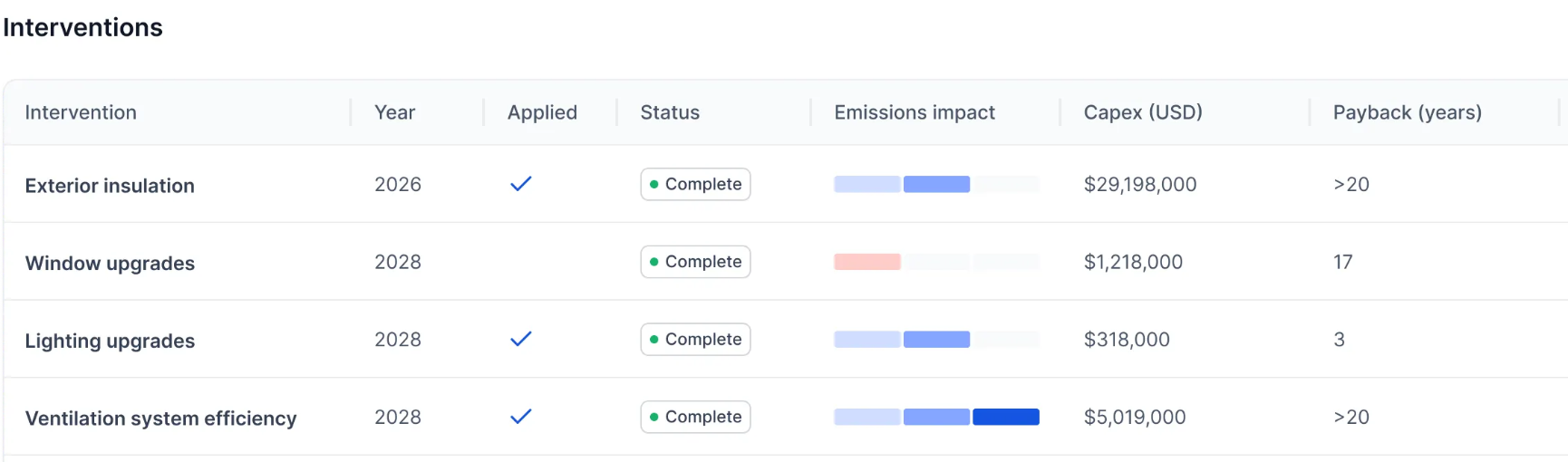

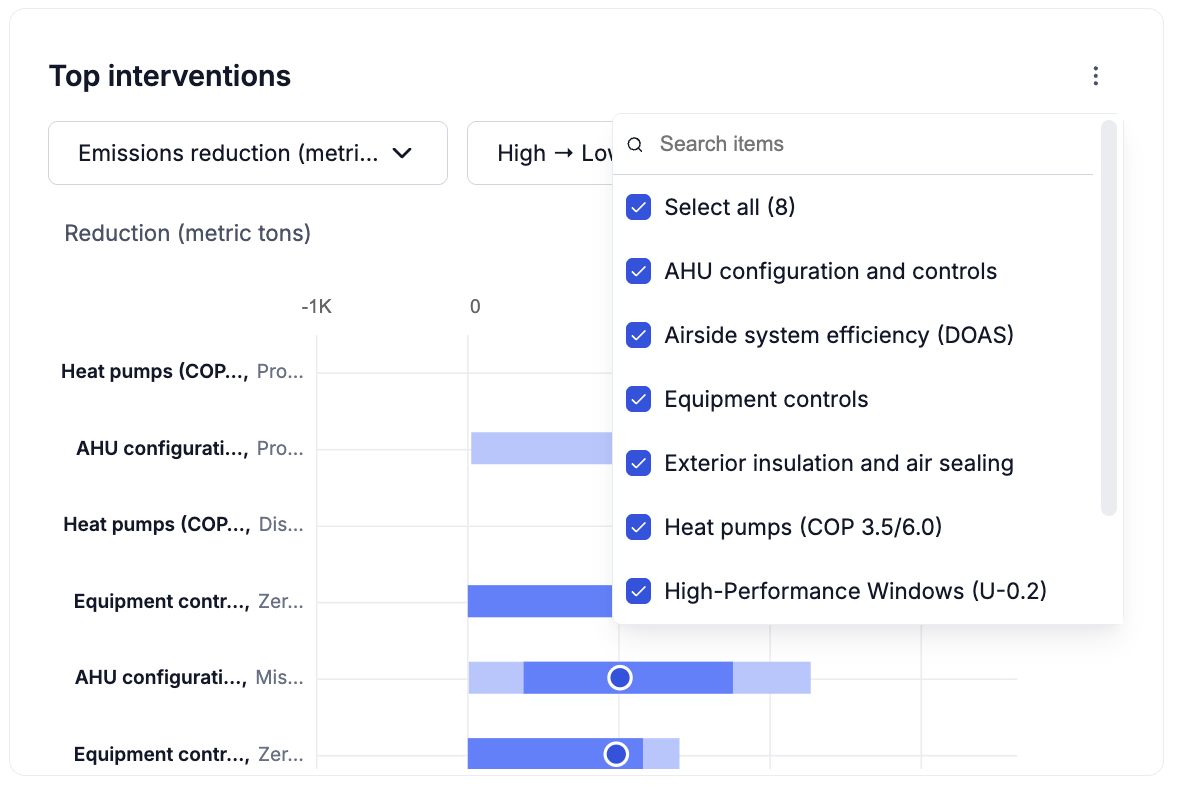

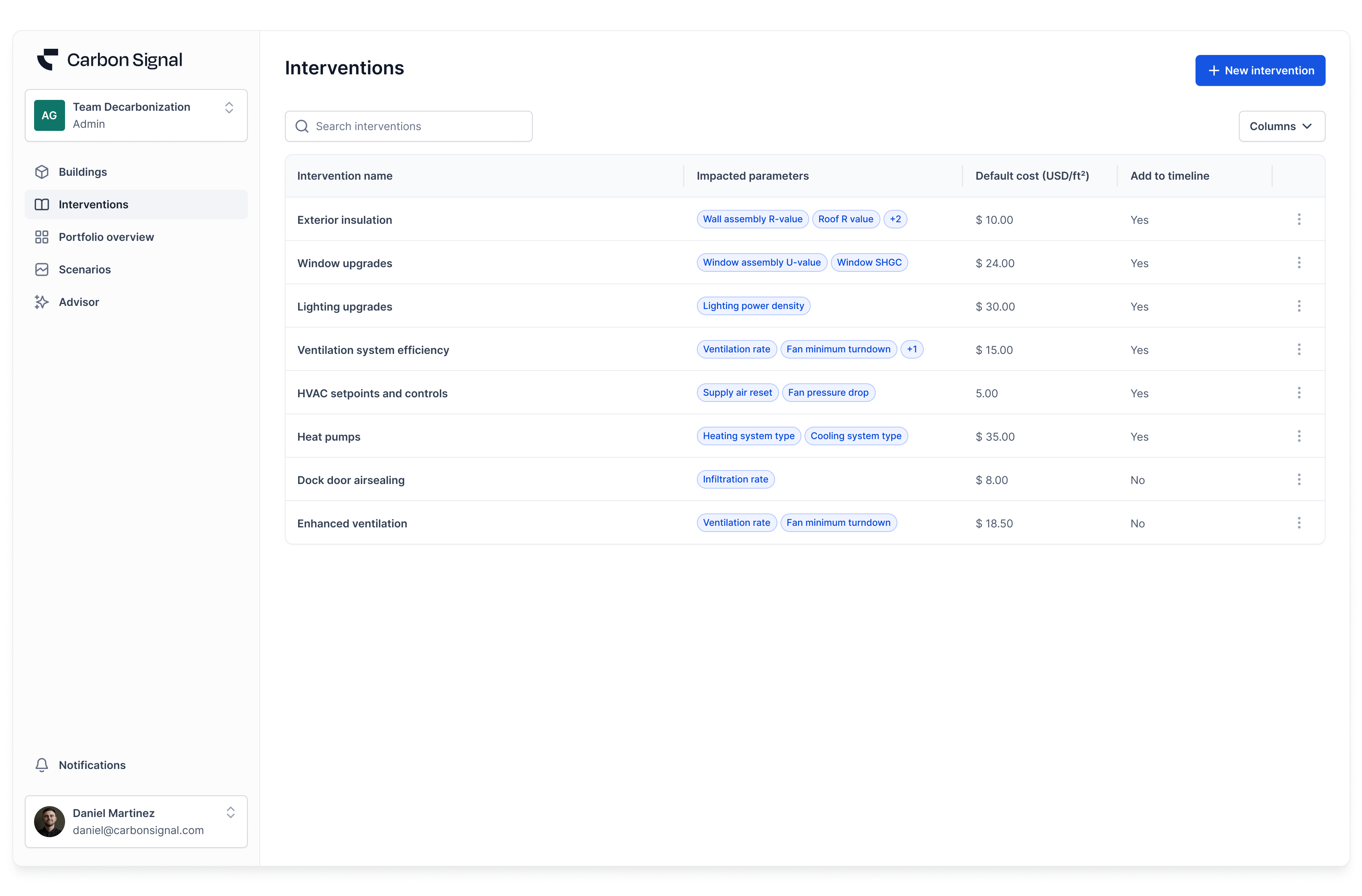

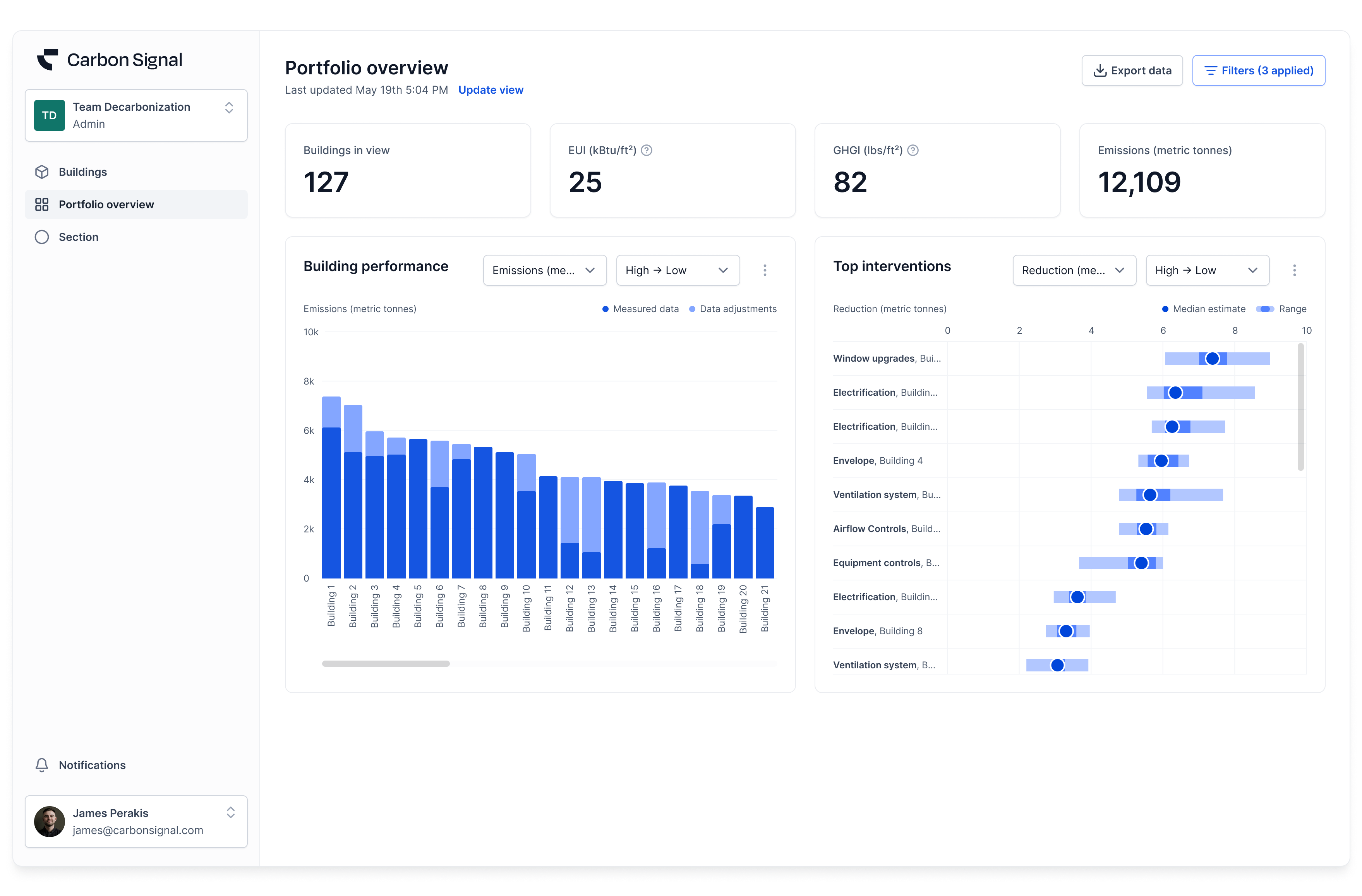

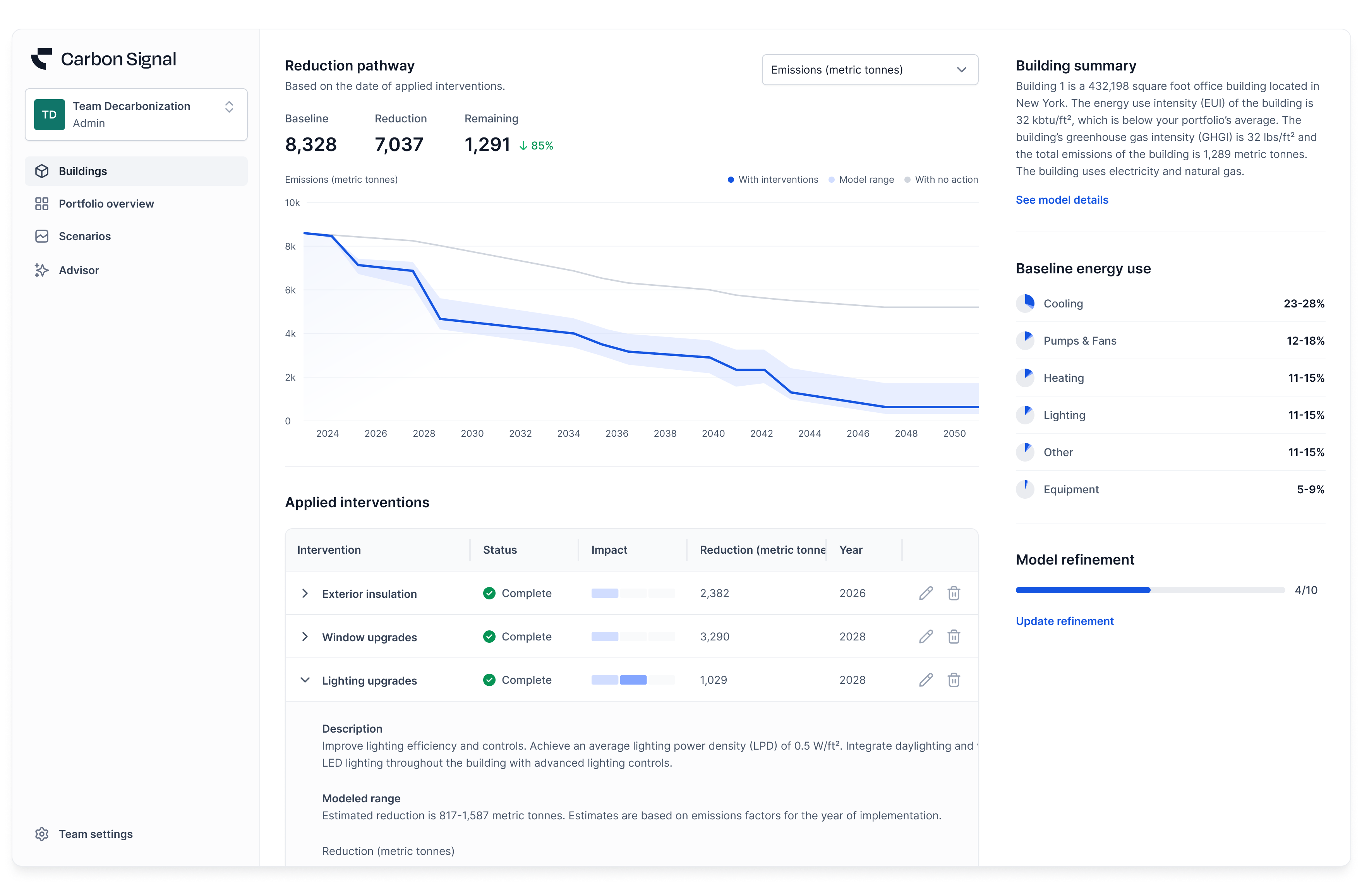

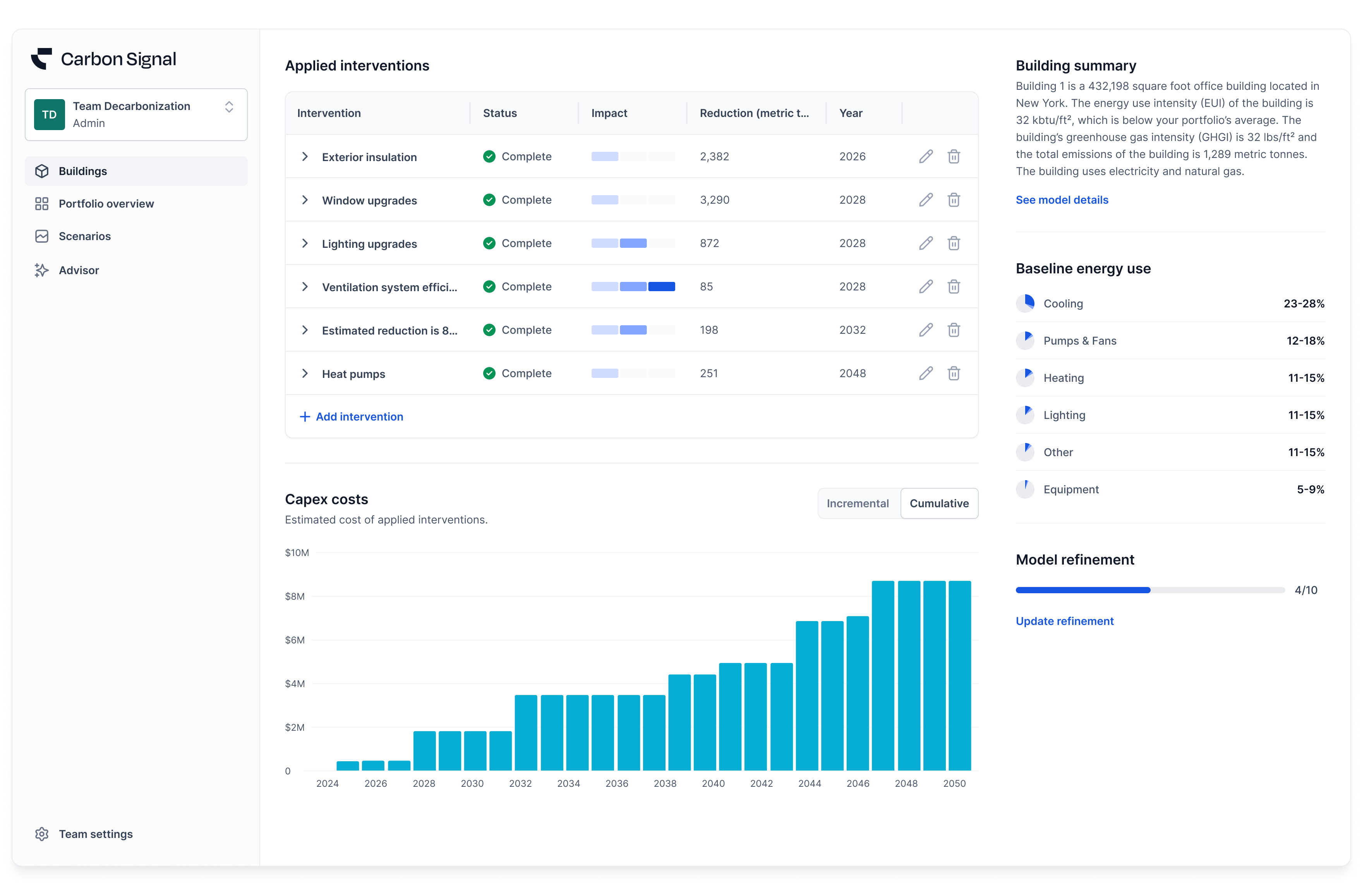

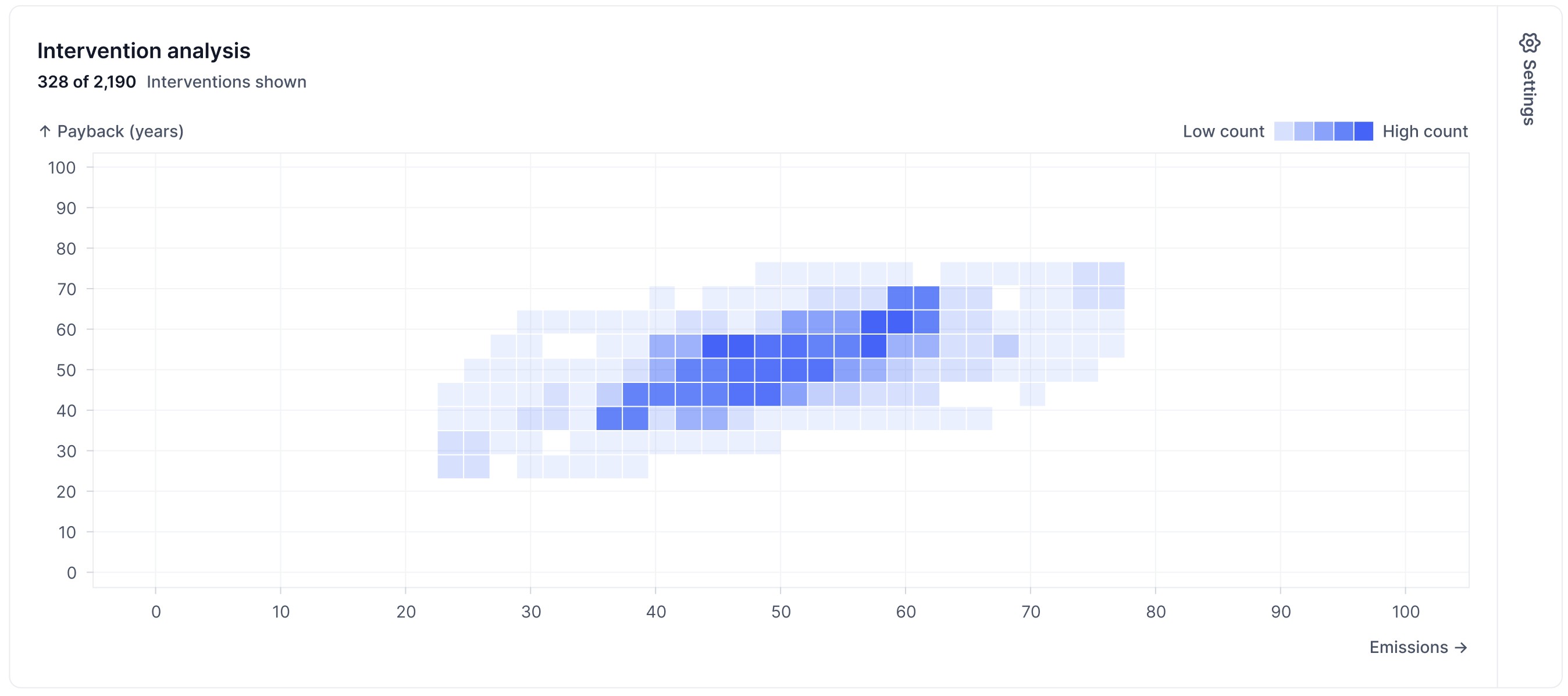

Intervention Heat Map

Carbon Signal now includes an interactive heat map on the Interventions page, allowing users to visualize and compare the performance of interventions across buildings.

The heat map displays interventions across two configurable axes, enabling users to evaluate trade-offs between different performance metrics. Both the horizontal and vertical axes can be adjusted to show metrics, such as:

- Emissions reduction percent or magnitude

- Energy reduction percent or magnitude

- Capital cost

- Utility cost reduction

- Simple payback period

- Year

This allows users to quickly identify interventions that balance emissions impact, energy savings, and financial performance.

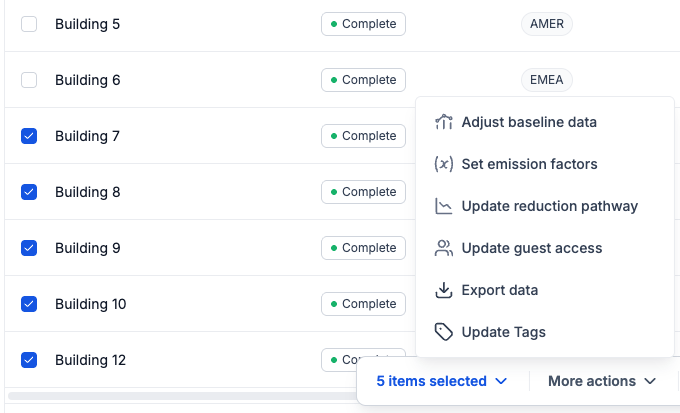

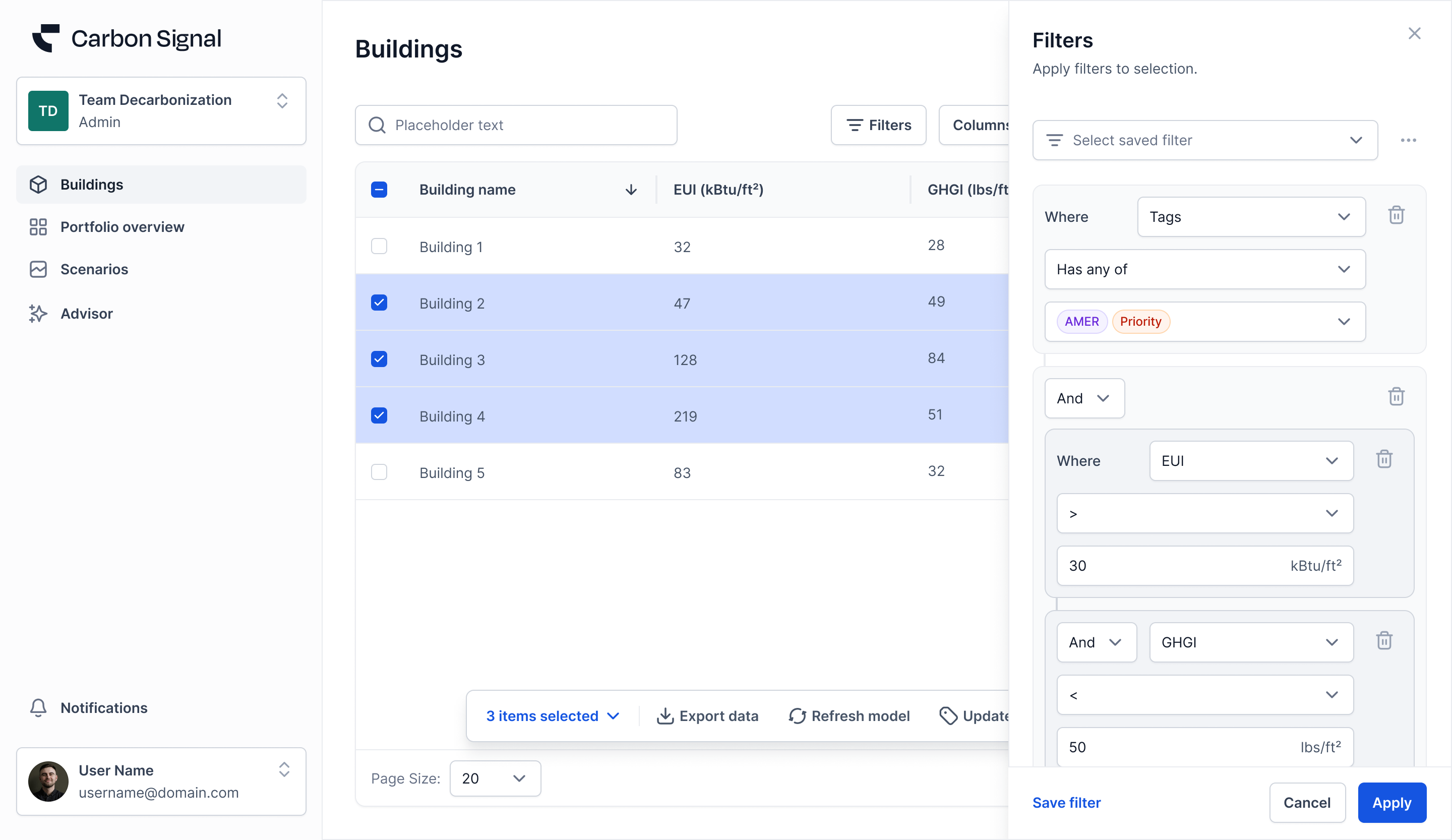

Flexible Analysis with Filters Across Interventions and Buildings

Filtering now includes advanced filtering capabilities, allowing users to refine results using both intervention-level and building-level attributes.

In addition to the existing building-level filters, Carbon Signal now includes intervention-level filters. Intervention-level filters apply to intervention metrics and attributes such as:

- Intervention

- Simple payback period

- Emissions reduction percent

- Emissions reduction magnitude

- Energy reduction percent

- Energy reduction magnitude

- Capex cost

- Utility cost reduction

- Year

Together, these updates make it easier to:

- Create buildings quickly, even with limited data

- Ingest utility data from audit reports and bills

- Compare interventions across buildings and portfolios

- Identify high-impact, cost-effective decarbonization strategies

These enhancements support more scalable, data-driven decision-making across large real estate portfolios.